The vibrant world of hair styling and salon ownership is a tapestry woven with creativity, passion, and the daily joy of transforming clients. From the artistic precision of a perfect cut to the chemical alchemy of a stunning color, stylists and salon owners pour their hearts into their craft. Yet, beneath the glamour and artistry lies a landscape of inherent risks that, if left unaddressed, can swiftly unravel even the most successful enterprise. This is where comprehensive insurance for hair stylists and salons steps in – not as an optional expense, but as an indispensable foundation for security, stability, and peace of mind.

Far too often, insurance is viewed as a mere compliance requirement or an unavoidable cost. However, for hair stylists and salons, it is a proactive investment, a robust shield designed to protect against the myriad of unforeseen circumstances that can lead to significant financial loss, reputational damage, and even the complete cessation of operations. Understanding the unique exposures faced by this industry and how specific insurance policies mitigate these threats is paramount for any professional looking to safeguard their livelihood and future.

The Unique Risks Faced by Hair Stylists and Salons

The salon environment, while seemingly benign, is a hotbed of potential liabilities. Every day, stylists handle sharp tools, potent chemicals, and heated equipment, all while interacting closely with clients in a fast-paced setting. The risks are diverse and pervasive:

- Physical Risks: Slips, trips, and falls are common occurrences in any public space, especially one with wet floors, dropped hair, or busy walkways. Clients can suffer injuries, leading to costly medical bills and potential lawsuits.

- Professional Risks: The very essence of hair styling involves direct service. Claims can arise from chemical burns, allergic reactions to products, hair damage due to improper application, or even client dissatisfaction with a haircut or color that they deem to be a professional error.

- Property Risks: Salons house valuable assets – styling chairs, sinks, dryers, specialized tools, extensive product inventory, and often the building itself. Fire, theft, vandalism, or natural disasters can wipe out these assets in an instant.

- Equipment Breakdown: Modern salons rely heavily on electrical and mechanical equipment. A sudden breakdown of an essential dryer, sterilizer, or even the HVAC system can halt operations and incur significant repair or replacement costs.

- Employee-Related Risks: Employees can suffer injuries on the job, leading to workers’ compensation claims. Furthermore, allegations of wrongful termination, discrimination, or harassment can result in expensive legal battles.

- Product Liability: If a product sold or used in the salon causes harm to a client (e.g., a shampoo causing a severe allergic reaction), the salon could be held liable.

- Cyber Risks: With online booking systems, digital client records, and payment processing, salons are increasingly vulnerable to data breaches and cyberattacks, risking sensitive client information.

- Business Interruption: An unforeseen event, like a fire or a major plumbing issue, could force a salon to close its doors temporarily, leading to significant loss of income and ongoing expenses.

Navigating this complex web of potential pitfalls without adequate protection is akin to building a house without a roof – it’s only a matter of time before the elements cause damage.

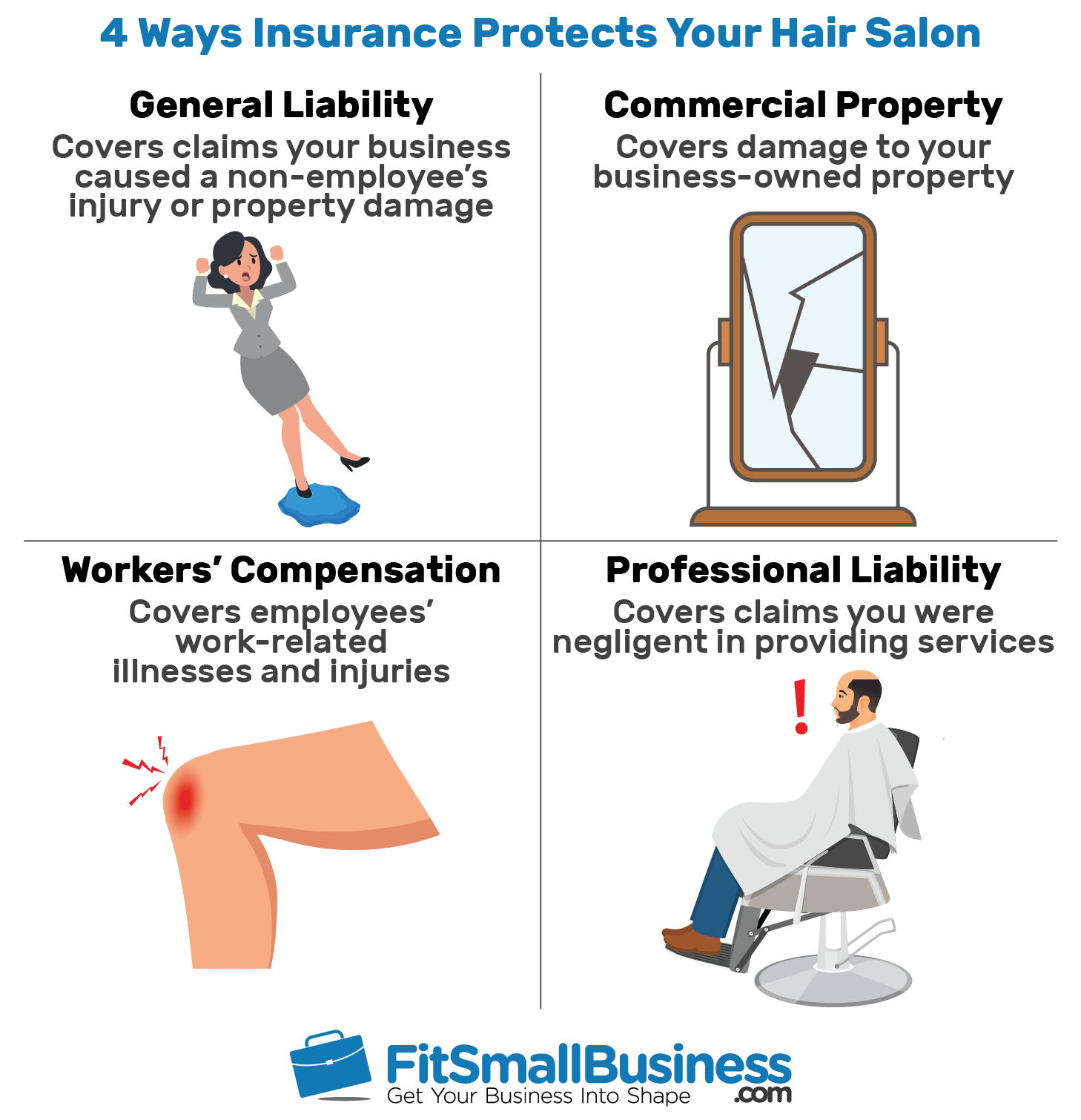

Core Insurance Policies for Hair Stylists and Salons

A comprehensive insurance portfolio for hair stylists and salons typically comprises several key policies, each designed to address specific risk categories.

A. General Liability Insurance (Slip-and-Fall Coverage)

Often considered the cornerstone of any business insurance plan, General Liability Insurance protects the salon from claims of bodily injury or property damage sustained by third parties on the salon premises or as a result of business operations. This is the policy that would respond if:

- A client slips on a wet floor and breaks their arm.

- A stylist accidentally spills hair dye on a client’s designer handbag, damaging it.

- A delivery person trips over a loose mat near the entrance and injures themselves.

General Liability covers the associated medical expenses, repair costs, and legal defense fees, regardless of whether the salon is found liable. Given the constant foot traffic and potential for accidents, this coverage is non-negotiable for any salon or independent stylist.

B. Professional Liability Insurance (Malpractice/Errors & Omissions)

This policy is arguably the most critical for service-based businesses like hair salons. Professional Liability Insurance, also known as Malpractice Insurance or Errors & Omissions (E&O) Insurance, protects stylists and salons from claims of negligence, errors, or omissions in the professional services they provide. This includes claims where:

- A client suffers a chemical burn from a hair coloring treatment.

- A client experiences severe hair damage or loss due to a styling procedure.

- A client has an allergic reaction to a product used during a service.

- A client claims dissatisfaction with a haircut or color, alleging it was performed negligently or below professional standards, leading to emotional distress or financial loss (e.g., needing corrective services elsewhere).

Without this coverage, a single claim of professional negligence could lead to devastating financial consequences, including substantial legal fees and potential settlement payouts.

C. Commercial Property Insurance

Commercial Property Insurance safeguards the physical assets of your salon. It covers the salon building itself (if you own it) and its contents, including:

- Business Personal Property: This encompasses all your essential equipment (styling chairs, shampoo bowls, dryers, sterilizers), tools (shears, clippers, brushes), furniture, fixtures, computers, and your valuable inventory of hair care products, dyes, and styling supplies.

- Perils Covered: Typically, it protects against losses from perils such as fire, theft, vandalism, smoke, windstorms, and certain other natural disasters.

Accurately valuing your property and inventory is crucial to ensure adequate coverage and avoid being underinsured in the event of a significant loss.

D. Business Interruption Insurance (Business Income)

Imagine a fire forcing your salon to close for several weeks or months for repairs. How would you cover your ongoing expenses like rent, utilities, and payroll without any income? Business Interruption Insurance, often included as part of a Commercial Property policy or a Business Owner’s Policy (BOP), provides coverage for lost income and continuing operating expenses if your salon is forced to close temporarily due to a covered peril. This vital coverage helps keep your business afloat during the recovery period, ensuring you can reopen without facing insurmountable financial strain.

E. Workers’ Compensation Insurance

If you employ staff, Workers’ Compensation Insurance is almost certainly a legal requirement in your state. This policy provides medical benefits and wage replacement for employees who suffer work-related injuries or illnesses. It protects both the employee by ensuring they receive care and financial support, and the employer by limiting their liability from employee lawsuits related to workplace injuries. For example, if a stylist slips on a wet floor and sprains their ankle while working, Workers’ Compensation would cover their medical bills and a portion of their lost wages.

F. Product Liability Insurance

While often included as part of General Liability, Product Liability Insurance specifically covers claims arising from bodily injury or property damage caused by products you sell or distribute in your salon. If a client purchases a shampoo from your salon and claims it caused a severe scalp irritation, this policy would respond to the resulting medical costs and legal fees.

G. Cyber Liability Insurance

In an increasingly digital world, salons utilize online booking systems, maintain digital client databases with personal information, and process electronic payments. This makes them targets for cyberattacks, data breaches, and ransomware. Cyber Liability Insurance helps cover the costs associated with a data breach, including:

- Notification costs to affected clients.

- Credit monitoring services.

- Forensic investigations to determine the cause of the breach.

- Public relations expenses to manage reputational damage.

- Legal fees and regulatory fines.

Protecting sensitive client data is not just good practice; it’s a legal and ethical imperative.

H. Commercial Auto Insurance (if applicable)

If your salon owns vehicles used for business purposes (e.g., for mobile stylists, product delivery, or running errands), Commercial Auto Insurance is essential. Personal auto policies typically do not cover vehicles used for business activities. This policy covers liability for accidents, as well as damage to your business vehicles.

I. Other Important Considerations and Endorsements

- Equipment Breakdown Insurance: Often an add-on, this covers the cost of repairing or replacing essential equipment (like HVAC systems, hot water heaters, or specialized styling tools) that break down due to mechanical or electrical failure, not just external perils.

- Employment Practices Liability Insurance (EPLI): Protects against claims made by employees alleging wrongful termination, discrimination, harassment, or other employment-related issues.

- Crime Insurance: Covers losses due to theft, fraud, forgery, or embezzlement by employees or third parties.

- Tenant Improvements and Betterments: If you rent your salon space and have invested significantly in leasehold improvements (e.g., custom cabinetry, specialized lighting, built-in styling stations), this coverage protects your investment.

Tailoring Your Insurance Portfolio

There is no one-size-fits-all insurance solution for hair stylists and salons. The ideal portfolio depends heavily on several factors:

- Size and Structure: A solo independent stylist renting a chair will have different needs than a large salon with multiple employees and extensive inventory.

- Services Offered: Salons offering complex chemical treatments, permanent makeup, or advanced aesthetic services may face higher professional liability risks than those offering only basic cuts and styling.

- Number of Employees: This directly impacts Workers’ Compensation and EPLI needs.

- Property Ownership: Whether you own or lease your salon building significantly affects your Commercial Property insurance requirements.

- Value of Assets: The total value of your equipment, tools, and product inventory dictates the necessary limits for your property coverage.

Working with an experienced insurance agent who specializes in the beauty industry is crucial. They can assess your specific operations, identify potential exposures, and recommend a tailored package that provides comprehensive coverage without unnecessary expenses. Furthermore, policies should be reviewed annually to ensure they still align with your business’s evolving needs and growth.

The Cost of Insurance vs. The Cost of Risk

While insurance premiums represent an ongoing expense, it’s vital to view them not as a drain on resources but as a strategic investment in risk management. The cost of a comprehensive insurance policy pales in comparison to the potentially catastrophic financial impact of an uninsured claim. A single slip-and-fall lawsuit, a severe allergic reaction claim, or a major fire could easily bankrupt a salon that lacks adequate coverage. Beyond the direct financial costs, there’s the invaluable peace of mind that comes with knowing your business is protected, allowing you to focus on your passion – creating beauty and serving your clients.

Tips for Managing Risk and Reducing Premiums

While insurance is your safety net, proactive risk management can help prevent claims and potentially lower your premiums over time:

- Implement Robust Safety Protocols: Use non-slip mats in wet areas, ensure proper ventilation for chemical services, maintain clear pathways, and regularly inspect electrical equipment.

- Comprehensive Employee Training: Ensure all stylists and staff are thoroughly trained in proper chemical handling, safety procedures, and client communication.

- Regular Equipment Maintenance: Keep all tools and equipment in excellent working order to prevent malfunctions and injuries.

- Secure Premises: Invest in good locks, alarm systems, and potentially surveillance cameras to deter theft and vandalism.

- Clear Client Communication: Obtain signed consent forms for chemical treatments, conduct patch tests for new clients or sensitive procedures, and clearly communicate potential risks and aftercare instructions.

- Maintain Detailed Records: Keep meticulous records of client services, products used, and any incidents or complaints.

- Bundle Policies: Often, insurers offer discounts for bundling multiple policies (e.g., General Liability, Property, and Business Interruption) into a Business Owner’s Policy (BOP).

- Maintain a Good Claims History: Fewer claims can lead to lower premiums in the long run.

Conclusion

In the dynamic and client-centric world of hair styling and salon ownership, passion and creativity are paramount. However, true longevity and success are built upon a foundation of diligent risk management. Insurance for hair stylists and salons is not merely a bureaucratic hurdle; it is the indispensable shield that protects your hard-earned assets, your reputation, and your ability to continue pursuing your craft. By understanding the unique risks inherent in the beauty industry and investing in a tailored, comprehensive insurance portfolio, stylists and salon owners can operate with confidence, knowing they are prepared for the unexpected, allowing them to focus on what they do best: making the world a more beautiful place, one client at a time. Do not leave your business vulnerable; consult with a qualified insurance professional today to secure your shield of protection.